My friends Lisa and Kyria have both posted about their spending for the last year or two and I am a big fan of talking about important things like money (mainly, because I think it shouldn’t be a taboo and because managing your money is not something that is taught in high school or college (which I think is a big mistake and should be changed, because too many people have problems managing their money in adulthood!).

I think it was very interesting to see how others spent their money. Spending is – as you can see if you do the comparison – a very personal matter and there is really no right or wrong in what you spend your money on. There are of course the necessities, but beyond that, what’s important to one person, might not even show up on the chart for another.

In attempt to be more transparent about finances and to maybe spark more conversation about it, I thought I’d jump on the bandwagon and share our 2015 spending report as well.

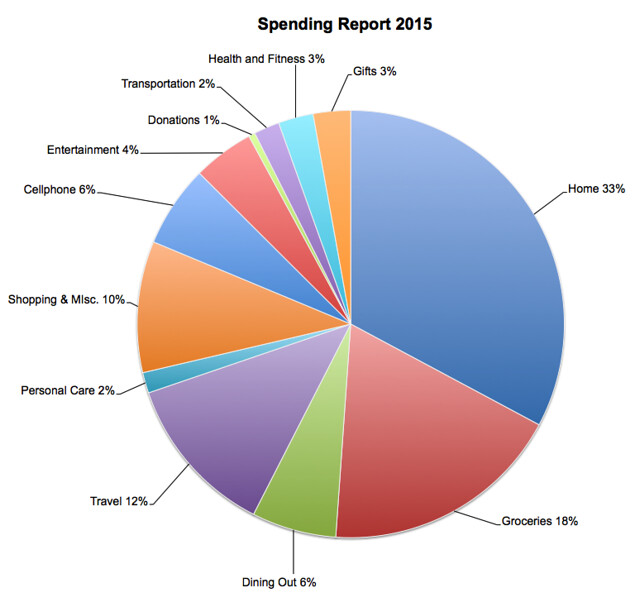

A few notes about our spending. This pie chart was created from my data in YNAB, the budgeting software I’ve been using since April 2015 (and which I reviewed here). I am still using YNAB and very happily so. They recently (as in: this month) came out with a new web-based version and I am trying that out parallel to the old desktop version and so far, I like it. One of the advantages is that you’ll now be able to import transactions directly from your bank account(s) (which didn’t really bother me before, but it is convenient!) and I love having the web-based version available anywhere if I want to look at something. I had a pretty good idea what we were spending before I started using YNAB, but since April, I have literally tracked every penny that went out of our accounts.

So, just to be clear, this is technically not our full 2015 spending report, but only for about 3/4 of the year, but I think it’s still a pretty good representation of our overall spending habits.

I also want to point out: these percentages are based on our actually spent money, not income (although this would be also very interesting statistic to explore). Not included are contributions to retirement funds and health care premiums (since they’re taken out of my paycheck before I even see the money) and personal savings.

So here’s the breakdown:

Home: This category included rent, utilities, household items, laundry money and (last year’s) moving-related expenses, which will probably be replaced with home maintenance this year.

Groceries: Yup. This is just our grocery spending (as you can see, dining out is its own category). I was honestly almost relieved that it wasn’t a bigger chunk of our overall spending. I realize, though: for many people that percentage is “a lot”. I mentioned before that we spent a lot at the grocery store, which I partly blame on food prices in California, but also: we like to eat and cook good food. I wrote about our grocery budget here. We meal plan, we do eat (organic) meat and dairy, we like to cook more complicated meals, and we like good coffee. But for the record, we hardly ever buy booze (which can be expensive). Still, my goal for 2016 would be to push that percentage down just a bit (as a challenge).

Dining Out: We get (cheaper) take-out maybe once a week or every other week, we go out maybe once a month.

Travel: Since my parents visited last summer and we went on a big 3-week adventure, I am not surprised that travel made up a larger chunk of our spending last year. But travel is always worth it.

Personal Care: This category includes all toiletry items, makeup, haircuts, and pedicures.

Shopping & Misc: This includes all expenses that didn’t really belong in any other category, e.g. impulse purchases, work lunches, annual membership fees, and parking. I realized that I also stuck many purchases in the ‘Shopping & Misc.” category, whenever I didn’t want to think about where a purchase actually might belong. This – in retrospect – was just the easiest solution at the time, but what I should have done is go back to reassign it to the correct category later (which I didn’t). So, some of the purchases in that category didn’t really belong there, but I didn’t have the time and energy to figure this out for all of our 2015 purchases (putting together this pie chart took me long enough – haha).

Cellphone: This one got its own category because man, cell phones are freakin’ expensive and it shows in my pie chart. I should add though that I am paying for a family plan with four lines and that I have successfully lowered a big chunk of our bill late last year, so I am hoping for this category to shrink in 2016.

Entertainment: This category includes Internet, cable, and our Netflix subscription. Even though it’s “only” 4% percent of our spending, I know that if we gave up cable, we could easily save some money here.

Donations: I wish this category was a little larger, but I am glad it’s even showing up percentage-wise on this pie chart. Always room to improve!

Transportation: Since I live close to my work, our transportation costs (mainly gas and bus fares) and car upkeep were a fairly small expense last year.

Health and Fitness: This category includes my gym membership and our medical and dental co-payments.

Gifts: This is a pretty straight-forward category and it includes birthday gifts, Christmas gifts and ‘just because’-gifts for family and friends. I like to give gifts.

Looking through our spending and trying to consolidate it into categories definitely has given me some food for thought on how I want to organize our budgeting categories better this year. As I mentioned, many things got put in the “Shopping & Misc.” category, even though they probably should have been recorded elsewhere. I definitely want to be more mindful about this in 2016.

I think the biggest areas of opportunity for us to make some changes are groceries, our cell phone bill, and entertainment. I realize that those are not all the biggest pieces of our pie, but they’re areas where I see some “easy” savings. I also don’t expect for the travel category to be that big in 2016 (although travel would not be something I’d necessarily want to cut out). I am, however, curious to see how home ownership will shape our spending this coming year.

I hope this post was at least remotely interesting for you. I personally enjoy these kind of honest posts.

What is the biggest piece of your spending pie? Do you have a budget and/or track your expenses?

Kate

January 25, 2016 at 8:27 amWithout a doubt, my biggest area of spending (aside from rent & bills) is entertainment – mostly food. I can’t fathom only going out to eat once a month! I’d say we go out to eat once a week, at least, &that’s probably a conservative estimate. I know I should tone it down, but we LOVE it…

KendraD

January 25, 2016 at 5:16 pmWe had to set a budget just for eating out, because we really love to dine out. It’s one of the ways we explore a city. Our budget is more about not just mindlessly eating out, rather than attempting to lower how much we eat out.

san

January 26, 2016 at 7:40 amNo need to be apologetic… this is exactly why I said early on that spending obviously is a very personal matter. You should spend your hard-earned money on what your heart desires and if that’s eating out, so be it! :)

suki

January 25, 2016 at 10:04 amlargest piece of the pie is related to housing costs – 34%. the second piece is related to food & dining, includes groceries AND restaurants – 17%.

san

January 26, 2016 at 7:41 am17% for groceries and eating out combined? Then you’re still doing much better than we do LOL…

suki

January 26, 2016 at 9:20 amI think we’ve been pretty good about a relatively low grocery bill, but we’re doing a terrible job with dining out. I blame it on city living, but also percentages don’t give the actual dollar amount we’re spending. :) It’s so much easier to just pick something up on the way home and NOT saying no to every birthday/catch-up dinner or brunch!

san

January 26, 2016 at 9:54 amTrue, the statistic would be more meaningful if actual $$ were attached to it. Still, it’s nice to see where one’s priorities lie ;)

Lisa of Lisa's Yarns

January 25, 2016 at 11:31 amI love that you shared your spending! I was a little nervous about doing it because it provides people an opportunity to ‘judge’ you but I got some really great comments from people. My biggest piece of the pie is definitely housing as I have high rent due to my location, but as a % of income it’s low – it just looks big as a % of spending because I don’t really spend all that much money in the other areas of my life. And it also includes the small net loss i was taking each month on the condo I rented out (which won’t happen in 2016 because I raised the rent quite a bit). So that confuses things a bit but it would have been too much work to try to take my mortgage payment/rent/etc out of that piece of the pie. My biggest opportunities for 2016 are to cut down on unnecessary spending. I want to be more mindful about the clothes I am buying and other unnecessary spending. I got rid of a lot of clothes in 2015 and updated my wardrobe so I had to spend more than I’d like on clothes but hopefully this year will be different!

san

January 26, 2016 at 7:42 amI understand that sharing finances gives people the opportunity to judge, but I also think being more transparent and talking about money and priorities can help get a bigger picture how finances work for oneself and everybody else. I appreciate that you shared your chart…. and honestly, unless we attach our income to it, this spending chart doesn’t really tell ALL that much ;)

Jenny

January 25, 2016 at 2:18 pmI love these pie charts. I’m a bit private about money, but these pie charts are about spending habits and I could get on board with that. I don’t currently track my spending, but I know that the biggest chunk is on housing and related expenses and race entry fees would probably have it’s own segment!

san

January 26, 2016 at 7:43 amYeah, it’s not like we’re sharing actual numbers… but I find it interesting to see where people’s priorities are.

KendraD

January 25, 2016 at 5:21 pmKudos to y’all for tracking your spending. We are terrible at this. We tried to set a budget when we lived in Turkey, but we didn’t base it off our actual spending habits so it was terrible. I think we both have mild PTSD related to budgets now so we mostly ignore it. We live within our means, but we definitely could do better at saving more.

That’s actually our goal for this year, so we’ve set a budget on dining out (exception being if we go out with friends or family) and have agreed to save a certain amount over each of our basic paychecks. So, when my husband gets OT, most of that goes to savings. Or, as I add students.

We probably should budget, but since we get away with not, we just don’t. I go back and forth on whether or not this is a bad thing.

san

January 26, 2016 at 7:44 amI think if you live within your means, you don’t necessarily need a budget.

We didn’t have a set budget for the longest time (because we never spent more than we had), but I started tracking our spending last year in order to get a better picture of where our money is actually going and to see if I agreed with how we spent our money.

Our budget is just a guideline, it’s not set in stone.

Stefanie

January 25, 2016 at 7:41 pmThis is really neat and something I’ve been wanting to do for the longest time. I don’t really track our spending nor do we set a budget because we know what we can afford and what we can’t. But what with a baby on the way and future daycare costs, this may not be a bad thing. I tried the YNAB site but felt like it wasn’t very intuitive, so I quickly abandoned it. Any advice? Right now I’m using an excel spreadsheet to track reoccurring expenses like utilities, rent, insurance etc.

san

January 26, 2016 at 7:48 amWe never had a real budget and I only started tracking our spending last year because I wanted to have a better picture of where our money was actually going (I knew that we spent more money on groceries than most people, but I didn’t know it was 18% of our overall spending ;)).

Our budget is still more a guideline than a set-in-stone spending limit. I just like the idea of assigning your dollars and then tracking where they go (I am a nerd).

If you want to elaborate (in email?) what bothered you about YNAB, I’d be happy to explain how I use it. (Did you try the desktop or new web version?)

If you’re not really looking to set a real budget, but just want to track your expenses, YNAB might not be the best tool for you (although it has a really nifty app that makes tracking expenses on the go real easy!).

Stephany

January 26, 2016 at 6:01 pmAside from rent/bills, my biggest spending area would definitely be dining out. This is an area I have tried to cut down, but honestly, I love eating out and at the stage of life I’m in, it’s just not something I care about cutting out/down. I’d rather try to cut down on other areas, like shopping and unnecessary spending.

san

January 27, 2016 at 9:44 amI think you’re absolutely right: if dining out is something you enjoy (and can afford!), why would or should you cut it down? There is no need for that (unless you’re unhappy with the money you’re spending).

Holly

January 30, 2016 at 12:16 pmWe have a budget and track our spending but I’ve never actually made a pie chart to see what percentage of our spending goes wear. It would definitely be interesting to see! I’ve tried mint.com but I don’t know, I guess I’m just old fashioned with my Excel spreadsheets! Our biggest expenditure is definitely groceries – Some months we actually spend more on food than our mortgage payments. I’ve been trying to make changes, shop around, cut back, etc. but there’s only so much you can do when food prices are so high! ($8 for cauliflower? Puh-lease!)

Travel Spot

February 1, 2016 at 8:18 pmThe quickest way to make your grocery percentage smaller is to spend more in the other categories! Just kidding. But seriously, it’s all relative, right? Also, I noticed you put your internet bill into Entertainment, whereas mine is in Home. I actually break mine down a bit more for myself, but a coworker joined me this year, so we tried to make the categories the same for both of our situations. I put all of my utilities and most of my Target/Amazon trips into Home rather than breaking them out into smaller or other categories.

My other one that could be better sorted would be running. Right now it’s in Entertainment, but if I go on a running weekend and I eat out and spend money on a hotel, is that Entertainment, Dining Out or Travel?? It’s hard to categorize later too, because I sometimes forget where I was or what I did. I also put all cash withdrawals into Travel because that is the majority of what I spent my cash on, although some probably could have gone towards Dining Out. It’s mostly correct!

I am glad you posted this as I love seeing how other people’s pies shake out! Your food category is a large percentage, but probably because you spend less on rent or one of the other categories… with no real numbers, it could mean anything!

Feisty Harriet

February 9, 2016 at 8:56 amOoooooooh!!!! This is so fascinating!!! I have *kind of* an idea of my spending, but I do love me a good pie chart!

xox