So, as I mentioned a couple of weeks ago, I wanted to talk about YNAB – You Need A Budget – a nifty little budgeting software. A friend had mentioned it on Twitter a little while back and initially I was only mildly interested and thought “yeah, maybe I’ll check it out – maybe not”.

So, as I mentioned a couple of weeks ago, I wanted to talk about YNAB – You Need A Budget – a nifty little budgeting software. A friend had mentioned it on Twitter a little while back and initially I was only mildly interested and thought “yeah, maybe I’ll check it out – maybe not”.

I was already using mint.com and while I was somewhat diligent about tracking what we were spending, I never seriously considered a budget.

I KNOW. Hello adulthood, right?

Now, I wanna preface this confession with the simple fact that I was raised responsibly and taught to live within my means and to save. I never borrowed money from friends or bought anything that I didn’t have enough money saved up for. If I didn’t have the money, I couldn’t buy it. Simple as that. Credit cards are not a “concept” for managing your finances in Germany.

Yes, credit card exist, but not to the extent that they’re available to anyone here in the US. And nobody really relies on credit cards for everyday expenses or (unnecessary) purchases you cannot really afford.

There are only a few things we buy as hire-purchases: houses and cars (because most people can’t buy those outright). Everything else is pretty much paid for on the day of purchase (or at the very latest at the end of the month).

I am not saying that Germans don’t accumulate any debt. It happens. But ‘living beyond one’s means’ is neither encouraged, nor something everyone just accepts as a necessary evil.

I do realize that not having to pay horrendous college tuition when you start out as a young person probably helps with the mindset.

use money that you have and save money where you can

All I wanted to say with this is: my (subconscious) ‘budget’ has always been to only use money that I have and save money where I can (in a non-obsessive way).

The transition from being a teenager/young adult with just “spending money”, but no real financial responsibilities to a working adult with an apartment and bills to pay was a learning curve, but nothing I felt I couldn’t handle.

Still, I never really made a budget. Not because I didn’t want to, but because I felt I didn’t need to. I didn’t allocate funds for certain expenditures. I considered everything ‘savings’ unless I had to pay a bill from it or decided to buy something (that I deemed necessary). Since I knew I always had more in my account than what I consciously needed, I didn’t feel the need to actively budget. But maybe this is actually what budgeting is, just not in the sense that I would say “I have $50 for clothing this month and that’s it. I can’t spend more than that”.

In a way, it was nice because I didn’t feel I had to limit myself (although if I am honest, the way I was raised to handle money subconsciously influenced my decision-making on what were worthwhile purchases to begin with. Not feeling limited is easy if you naturally limit your spending and are not constantly fighting the urge to consume.)

I understand that other people struggle more with their spending or were forced to deal with student loan debts that they had no way to avoid.

If you’re that person, YNAB is definitely for you. The software is designed to help you manage your finances, pay off your debt and budget for your everyday expenses and towards a rainy day fund and long-term savings. But in my review, I also wanna make the case that YNAB is for you if you don’t have any debt, already have a working budget and good handle on your finances and are not living paycheck to paycheck.

know where your hard-earned money goes

It’s extremely rewarding to not only know where your (hard-earned!) money goes, but knowing that you have planned for every single dollar.

I’ve been using YNAB for only a couple of months now, but I was pretty much sold on the approach instantly.

The process is fairly simple. I am not going to explain how to set up and use the software (the process is pretty straight-forward with plenty of help along the way).

But the ground-breaking difference to other spending softwares is that with YNAB you’re not just tracking your spending (in retrospect), but you’re looking ahead and keep an eye on the money that is available in each spending category for the month.

stop spending according to your bank account balance

You will stop spending according to your bank account balance, but instead live by the “available budget” for each expense category in YNAB. The software does the math for you – you put in your spending and it always tells you how much more money is available for each category for the rest of the month.

Since you budgeted all your recurring bills, rent, and other necessary upcoming expenses in advance (when there is money available to budget), you won’t (or shouldn’t) be able to see that money as “available” to spend on something else.

YNAB’s four rules

YNAB has four rules to live budget by.

That simply means: no dollar just “hangs out”. You either budget it towards your expenses or decide to put it into savings, but nothing is left “unbudgeted”. If you have all your fixed expenses budgeted for, the leftover money can help to “cushion” your expense categories to ‘have a little extra’ just in case, go into your emergency fund or towards “fun money”, but you have to assign it a ‘job’.

This second rule helps you budget in advance for less-frequent, but recurring expenses (like the annual car registration, quarterly insurance premiums, Christmas (!) etc.) and also helps to stash away some funds for expected, but less predictable expenses (like car or home repairs, vet bills, etc.) By putting a little bit of money in these categories every month (you can for example figure out to the dollar how much you need to put away if your insurance premium is going to be $300 in six months), your “rainy day fund” will grow and you’ll have peace of mind that you’ll have the money in your account when the bill comes due. No “shit-I-forgot-about-this-bill”-surprises anymore!

A budget is not rigid. It not only will, but needs to be adjusted every month. The goal of budgeting is not to be able to anticipate your spending down to the penny and stick to the same budget amounts every month. It’s simply not feasible. Life is not predictable like that and every month will be a little bit different.

The goal is to ‘roll with the punches’ and adjust and tweak your budget every month accordingly. Overspent in one category? Make adjustments (e.g. take away some dollars from another category to cover the extra-costs). If you can’t or choose not to, the software will automatically deduct the overspent amount from next month’s money and you’ll just have to tighten your budget next month. On the flipside: if you don’t use the budgeted amount in a category, it will roll over to next month, too and you’ll have a little extra money as a buffer. Not every month will be the same, but you can strive to balance out between the months. It all comes down to try really hard to just spend what you have!

This last rule is really geared towards people who currently live paycheck to paycheck and struggle every single month to pay their bills, because they’ll be covering those bills with money that don’t yet have in their possession. The goal here is to save up enough money (roughly the equivalent to what your regular monthly income is) and then live off that money the following month. If you manage to get there, you’ll always be “one month ahead” and there is no guessing game of how much money you have to work with in each given month, because the money is already in your bank account.

So, even though I don’t have any debt to pay off and savings that I can dip into if need be, this way of thinking about your budget and how to manage your money (as in, your monthly income) makes a lot of sense to me.

the software also comes with an app

Tracking expenses is not something I overly enjoy, but I also don’t mind it and the software also comes with an app that makes tracking “on the go” really easy. It’s really just a matter of getting into the habit. I don’t even think twice about it anymore and J even casually reminds me when we spend money to write it down. (← Yes, get your spouse or significant other on board!)

The software itself – a download, not web-based – has an eye-pleasing, easy-to-use interface and it definitely speaks to my nerdy side. What can I say, I just like to crunch numbers and see things neat and organized.

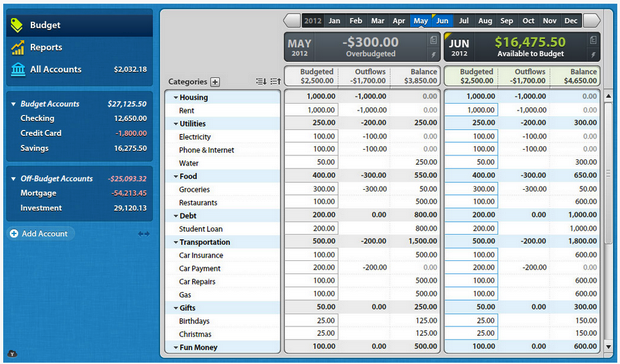

© ynab.com (not my financial situation – ha!)

You can customize pretty much any aspect of this software to your liking. You can create new categories, organize them in different ways (by pay cycle, importance, alphabetically…) and delete categories you don’t need.

You budget money in the “budgeted” column, the software keeps track of your spending in the “outflows” column and the most important column for you is the “balance” column, because this is where you’ll check how much money is available for spending. (Conveniently, you can check this in the app while you’re out and about and before making any purchases. Talk about holding yourself accountable!)

The software does not connect to your online accounts (which is not a big deal for me), but you can either download your bank statement and import it into YNAB or post transactions manually (which is what I do, because I do track spending on a daily basis anyway. I just reconcile my account at the end of each month to make sure I didn’t miss anything.) I find this interactive part highly valuable in the budgeting process, because you’re forced to log and look at every individual expense.

Bottom line: This system really works, if you’re willing to put in a little bit of time upfront (and if you’re only half as nerdy as I am, you’ll have fun in the process, too!).

Phew, this got waaay longer than anticipated.

Do you have any more questions I can answer?

I have not been compensated by anyone for this review. The opinion is solely my own.

If you feel like this software could be for you, download the fully functioning trial version and give it a shot! If you like it, you can use this link: https://ynab.refr.cc/Q7D6NSR to activate the software after the trial period with a 10% discount.

Lisa of Lisa's Yarns

July 2, 2015 at 11:22 amI had not heard about this until you mentioned it. I use mint.com and feel like it works for my needs – plus I like that everything automatically loads in there since it’s connected to all of my accounts. I have always been responsible with my money but I have become much more intentional about my spending/saving since entering my 30s. Now I am really proud of how much I save each month.

Stephany

July 3, 2015 at 7:12 pmThis is so interesting and I’m so glad you did such a thorough review! I am really thinking about trying this budgeting software out because I definitely need help with how I manage my money. I mean, I pay my bills on time and don’t spend past my means, but I could do a much better job at saving and paying off my debts (school loans – UGH).

Jaina

July 9, 2015 at 1:33 pmFellow user and fan of YNAB. I wasn’t sure about it initially, but it’s really helped highlight to my SO and I where we spend our money. I’ve never been “bad” with money really, but when I moved in with my SO we needed to split our finances better. YNAB has really helped us in that respect.

suki

July 9, 2015 at 2:40 pmthanks for the thorough review of this! i’ll have to check it out. :)

Amber

July 20, 2015 at 1:48 pmMy coworker and her husband have had great success using YNAB! I tried it for a bit but it just didn’t work for me/us with the way we currently budget since we pay for a lot of things with cold hard cash! I think it seems like a really awesome tool though and I think my favourite tip of there’s is to live on last months income!